Texas Homeownership Costs: What Buyers Really Pay (MUD, PID, HOA)

The REAL Cost of Homeownership in TEXAS: Covering MUD/PID/HOA Taxes

Buying a home in Texas comes with incredible benefits such as no state income tax, strong job growth, and more new-construction opportunities than almost anywhere in the U.S. But to understand your real monthly payment, you have to look beyond the purchase price.

Texas property taxes, MUD rates, HOAs, PIDs, and insurance all affect what your budget truly feels like month-to-month.

This guide gives you a clear, numbers-driven breakdown so you can compare neighborhoods across Greater Houston with confidence and avoid payment surprises.

Property Taxes (The Biggest Monthly Variable)

Texas doesn’t have state income tax, so property taxes fund schools, utilities, roads, and local infrastructure. As a result, tax rates are higher than many states.

Here’s what you’ll typically see across Greater Houston:

- 1.6% – 1.9% → Older communities / no MUD

- 2.2% – 2.8% → Most newer master-planned communities fall here

- 2.9% – 3.4% → New construction, heavy infrastructure communities, fast-growth areas

- 3.5%+ → Early-phase communities where bonds are not paid down yet

What drives tax rates?

- School districts

- MUD/PID district debt

- County/road bonds

- Services provided by the community

Even two homes priced the same can differ by $300–$500+ per month simply due to tax rate differences. Always verify the exact rate for the specific home, not just the neighborhood.

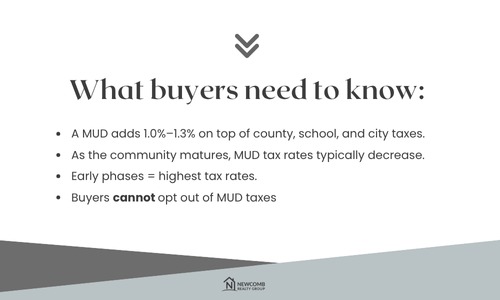

MUD Taxes (Municipal Utility District)

Most master-planned communities in Texas fall within a MUD, and the rate is tied to the community’s bond debt. As the bonds are paid down, typically over 20–30 years, the MUD rate decreases, which is why early phases usually have the highest taxes.

MUD taxes fund:

- Water + sewer systems

- Drainage

- Roads

- Initial development infrastructure

A MUD generally adds about 1.0%–1.3% to your total tax rate, and the amount can vary even between sections of the same neighborhood. Because the tax is tied to the land, buyers can’t opt out. Higher MUD rates impact monthly affordability and resale value, while established communities often use lower MUD rates as a selling point.

PID Taxes (Public Improvement District)

A PID is a special assessment used to fund community enhancements like upgraded parks, landscaping, trails, lighting, and public spaces.

Key things:

- Not every neighborhood has one.

- PID payments can be annual or added to your tax bill.

- Amounts range from $300–$2,000/yr depending on community.

Unlike a MUD, a PID doesn’t fund core utilities. Instead, it covers upgrades, beautification, and community improvements, sometimes with an option for early payoff that can help resale value. Because buyers shop by monthly payment, higher PID fees can impact affordability. In Greater Houston, PIDs are most common in fast-growing new communities in Fulshear, Katy, Magnolia, Tomball, Hockley, Waller, Conroe, Willis, Manvel, and Iowa Colony. You can confirm whether a home has a PID in the seller disclosures or through the county appraisal district.

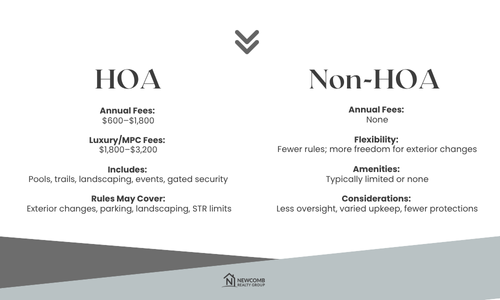

HOA Fees vs. Non-HOA Communities

Choosing between an HOA and a non-HOA neighborhood is a key part of finding the right home, and understanding how each one works can help you decide what best fits your lifestyle and budget.

HOA Communities:

- Typical range: $600–$1,800/yr

- Luxury or heavy amenity MPCs: $1,800–$3,200/yr

- Fees cover: pools, trails, landscaping, events, security gates, resort-style amenities

- HOAs can include rules on: extreior changes and paint approval, parking and street restrictions, landscaping standards, short-term rental limits

- Most new master planned communities in the greater Houston area require HOAs

Non-HOA Homes:

- No annual fee

- No restrictions, more flexibility with exterior changes and general use

- Typically offer fewer amenities

- BUT: often smaller amenities, lower upkeep standards around you, fewer neighborhood protections

- Non-HOA acreage neighborhoods are common in Waller, Magnolia, Stagecoach, Hockley

Once you know how each option impacts your daily life and monthly budget, it becomes much easier to decide which type of neighborhood is the best fit for you.

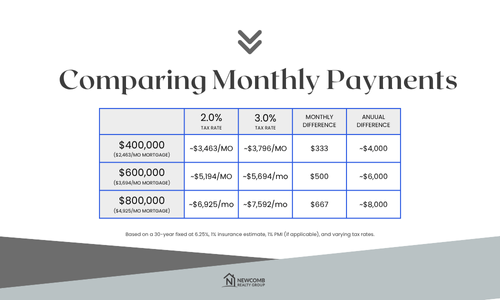

What a Real Monthly Payment Looks Like

Below, we break down how your monthly payment can change based solely on the tax rate, even when the home price stays the same. By comparing a 2.0% and 3.0% tax rate across $400K, $600K, and $800K homes, you can see how taxes directly impact affordability. In some cases, the difference is several hundred dollars per month - adding up to thousands per year for the same home price.

This is why your budget matters more than the list price in Texas. A good agent should break down every cost : tax rate, HOA, MUD, PID, insurance, CDD/PUD (in rare cases), builder fees, and lot premiums, so you know the true payment for each home.

How to Shop Smart in 2025–2026

Before choosing a home, make sure you understand the full financial picture. Ask these five questions during every tour:

- What is the current tax rate, insurance ranges?

- Is there a MUD or PID, and how long until it decreases?

- What are the HOA fees?

- How does this neighborhood compare to nearby options?

- What will my total monthly payment be — not just the purchase price?

Buyers who shop based on payment instead of price make stronger, more confident long-term decisions.

Final Thoughts

Texas remains one of the best places to buy thanks to affordability, job growth, and no state income tax, but the biggest mistake buyers make is ignoring taxes and fees until they’re already under contract.

At Newcomb Realty Group, we break down every cost up front:

- Exact monthly payment

- Tax rate & MUD/PID details

- HOA fees

- Insurance estimates

- Neighborhood comparisons

- Builder incentives & lot premiums

Your payment will never be a surprise and you’ll always shop with clarity and confidence.

Ready for a customized cost breakdown for any home in Greater Houston?

Contact Newcomb Realty Group today.

📞 Book a consultation call: 832-779-5478

🌐 Visit our website: www.newcombrealtygroup.com

📲 Connect with us: Instagram | Facebook | TikTok | YouTube | LinkedIn

Categories

Recent Posts

Realtor® Listing Specialist and Team Lead | License ID: 634969

+1(972) 821-1513 | kristina.newcomb@exprealty.com