Will Houston Home Prices Drop in 2025?

Last updated November 1, 2025

Will Houston Home Prices Drop in 2025? What Buyer and Sellers Need to Know for 2026

If you’re a Houston homeowner, you’ve probably been asking: “Are home prices going to drop this year?” It’s a fair question especially after years of rapid growth. Let’s break down the numbers, what’s driving the market, and how you can prepare your home to buy or sell successfully before 2026.

The Big Question: Will Home Prices Drop?

It’s the question every homeowner and buyer is asking right now.

While national headlines paint a mixed picture, the Houston market tells its own story. Despite higher interest rates and shifting buyer demand, local home values have remained remarkably steady.

According to the Houston Association of Realtors (HAR), prices have plateaued rather than dropped. Demand continues in high-growth areas like Katy, Cypress, and Hockley, where new construction and job expansion are keeping the market balanced.

Bottom line: Houston isn’t showing signs of a price crash. If mortgage rates ease slightly in 2025, as many analysts predict, buyer activity could rise, giving well-prepared sellers a strong advantage.

FAQ:

-

How much have Houston home prices increased recently? Prices have risen 5–7% over the past 12–18 months, with suburbs like Katy and Cypress seeing slightly higher gains.

-

Will interest rate changes affect selling prices? Slightly higher rates can reduce buyer purchasing power. Even so, Houston’s market has remained strong. Sellers can offset impacts by pricing realistically and highlighting move-in-ready features.

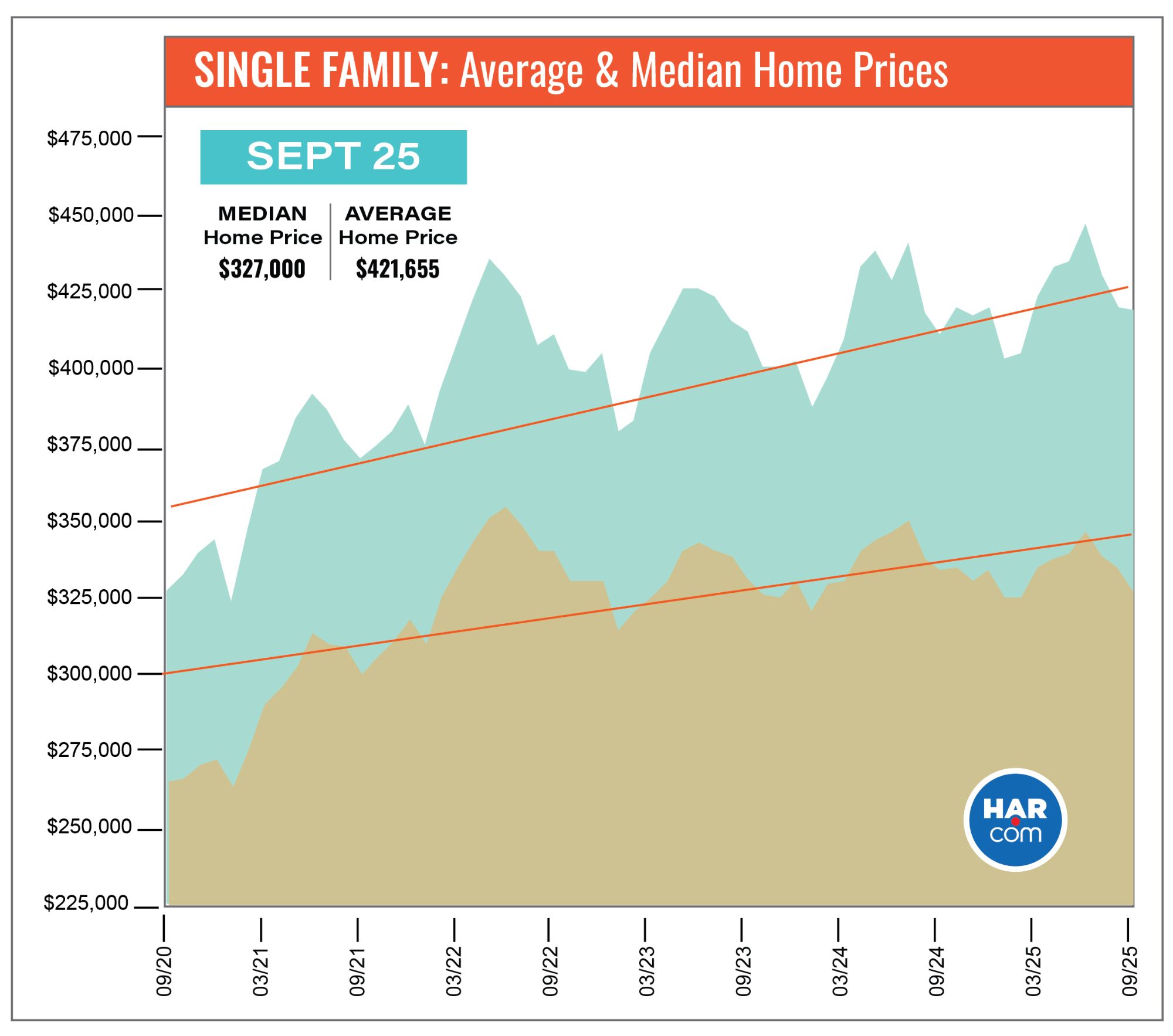

Average and median home prices in the Houston area according to HAR.com

What’s Driving the Market Right Now

Three key forces are shaping Houston real estate:

-

Interest Rates: The average 30‑year fixed mortgage rate through much of 2025 hovered around 6.8% nationally. Locally in Houston the reported rate for early October 2025 was ~6.17% for 30‑year fixed. This means buyers still face higher borrowing costs than pre‑pandemic, but the relative local rate provides a slight competitive edge.

-

Job Growth: Houston’s economy remains diversified with strong presence in energy, technology, healthcare and logistics. Major employers such as BP, Shell, and Houston Methodist continue active hiring, helping sustain residential demand.

-

New Construction: Suburbs like Katy, Texas, Cypress, Texas and Hockley, Texas remain hot spots because they offer new‑home inventory, good schools and commuting access to Houston. According to the local market, this helps prevent sharp price drops even when buyer demand shifts.

Result: For sellers: homes that are priced correctly, show–ready, and targeted to the right sub‑market will continue to sell well. For buyers: while you may not expect deep discounts, there is opportunity in choosing a home that meets your criteria now, before competition increases.

FAQ:

-

Are certain neighborhoods better for sellers? Yes. Katy, West University, and Cypress have high demand, low inventory, and strong schools.

-

How long are homes staying on the market? As of late, the average DOM (days on market) in Houston is 55 days, but well-prepared homes often sell in 2–3 weeks.

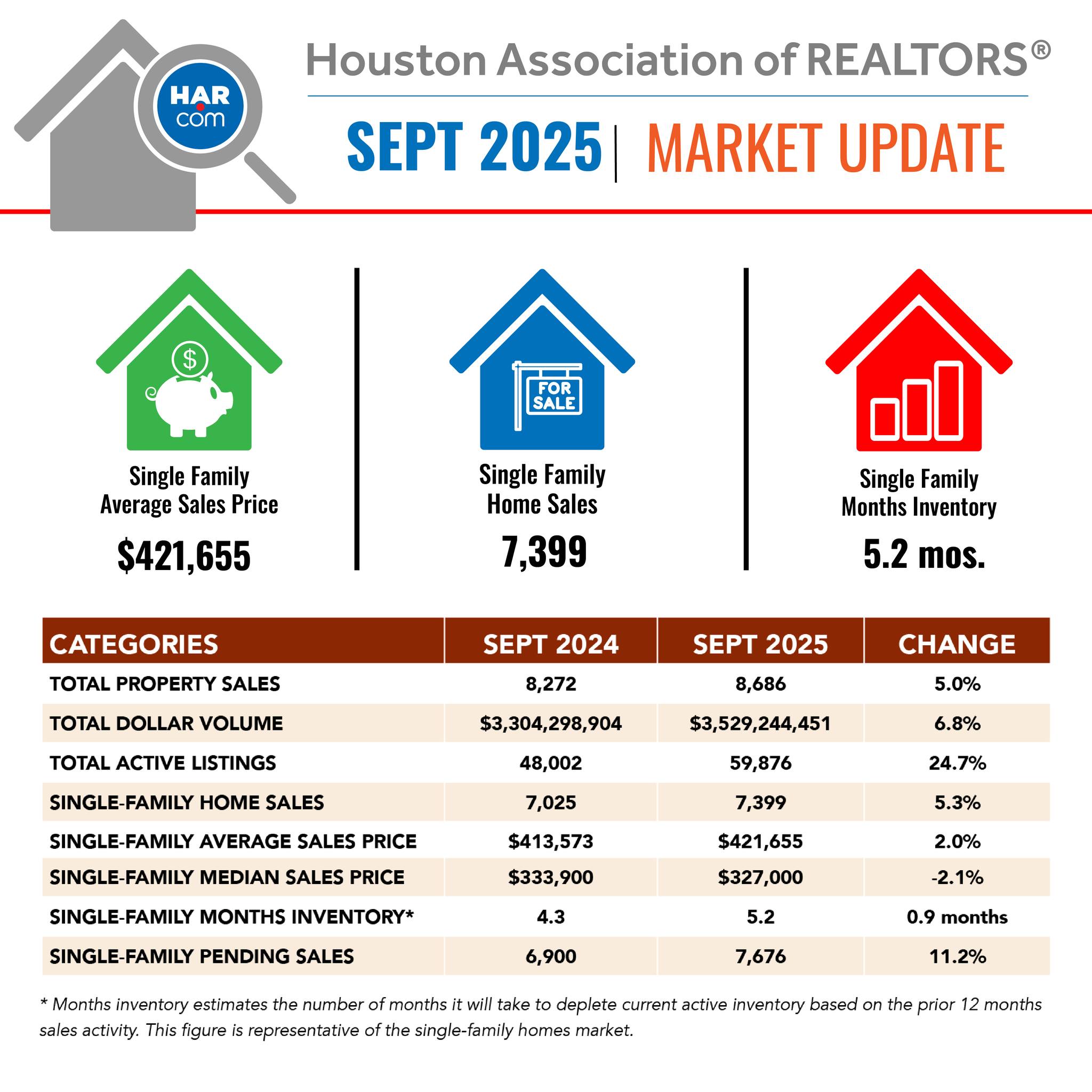

September 2025 Market Update from HAR.com

How to Buy a Home in Houston in 2026

Here’s how to position yourself for success in next year’s market.

1. Get your financing in order early. Interest rates and lending standards can shift quickly. Before touring homes, connect with a trusted local lender to: Get pre-approved, explore loan programs, and lock in your rate when the timing makes sense.

2. Choose a neighborhood that fits your lifestyle. The key is knowing where you’ll get the most value for your lifestyle and long-term goals. Here are a few neighborhoods and suburbs to keep on your radar: Cypress & Bridgeland, Katy, Hockley & Waller County, The Heights & Garden Oaks, and Richmond & Rosenberg.

3. Explore new contruction vs resale homes. Houston’s new-home market will remain active, with builders competing through incentives, upgrades, and flexible timelines.

4. Watch for market timing and inventory. Experts predict Houston will remain relatively balanced in 2026. It won't be the intense bidding wars of 2021–2022, but still competitive in desirable price ranges.Winter to early spring could bring the best builder incentives while late spring to summer usually sees more inventory but higher competition.

Tip: Partner with a local realtor who knows the market, provide more insight, and can help you buy smart and confidently.

FAQ:

-

Is it smarter to wait for prices to fall before buying? Probably not. Houston’s market has stabilized and rising rents or rate changes could cost more in the long run. Focus on finding the right home at the right payment, not perfect timing.

-

Where can I get personalized advice? Reach out to Newcomb Realty Group for a customized plan. We’ll help you navigate today’s market confidently and make the most of your next move.

How to Prepare Now for a Successful 2026 Sale

The key to a smooth, profitable sale is preparation. Starting early gives you time to make your home shine, attract serious buyers, and get top dollar without feeling rushed. Here’s a simple timeline to guide you:

3–6 Months Out: Declutter, deep clean, and make minor repairs. Consider staging.

30–60 Days Out: Take professional photos, boost curb appeal, and finish small upgrades.

Listing Time: Price smart, market widely, and keep your home show-ready.

FAQ:

- Should I make big renovations? Only if ROI is high. Small updates usually outperform major remodels.

- When should I list for the best price? Late winter to early spring is traditionally strong, but preparation matters more than timing.

Fresh paint and new backsplash makes for an easy update but big transformation.

Pricing Strategy: Avoid These Mistakes

In a shifting market, pricing your home correctly is more important than ever.

Overpricing can lead to longer market time and repeated price cuts; for example, homes overpriced by 10% can stay on the market 30–60 days longer than correctly priced homes.

Underpricing can leave money on the table, especially in high-demand neighborhoods like Katy, Cypress, and West University Place.

Tip: An expert local agent understands micro-markets- correct pricing is part data, part experience.

FAQ:

-

-

How do I determine the right listing price? A local realtor can use a Comparative Market Analysis (CMA), factoring in upgrades, lot size, and features.

-

How much do buyers negotiate? On average, 2–5% off the listing price, though hot neighborhoods often get offers at or above asking.

-

So.. Will Prices Drop or Not?

Houston’s strong job market, steady population growth, and ongoing demand in suburban neighborhoods like Katy, Cypress, and Hockley are keeping housing values stable. While minor price adjustments are possible in certain pockets, a major drop across the city is unlikely.

Opportunity for sellers: Homes that are priced correctly, well-presented, and prepared thoughtfully still attract serious buyers quickly. Acting now allows you to sell before the 2026 market becomes more competitive and before interest rate shifts or new inventory changes the landscape.

For buyers, this means homes are still a solid investment, and there are opportunities to find properties with great potential, especially those that may need minor updates or are in growing neighborhoods.

Ready to Talk Strategy?

Contact Newcomb Realty Group today for a personalized buyer or seller consultation and get expert guidance every step of the way.

Phone: 832-779-5478

Website: www.newcombrealtygroup.com

Social Media: Instagram | Facebook | TikTok | YouTube | LinkedIn

Categories

Recent Posts

Realtor® Listing Specialist and Team Lead | License ID: 634969

+1(972) 821-1513 | kristina.newcomb@exprealty.com