The Complete Step-by-Step Home Buying Process in Texas

The Complete Step-by-Step Home Buying Process in Texas

Your clear, straightforward roadmap to buying a home in Texas, whether you’re local, relocating, or planning your first purchase.

Buying a home in Texas can feel overwhelming, especially with our unique laws, taxes, and closing steps. This guide walks you through the entire process from start to finish with Houston-area specifics, clear examples, and real-world advice from Newcomb Realty Group.

Step 1: Set Your Budget

Before you begin touring homes, take time to get clear on your ideal monthly payment and what truly matters in your next community. Consider the following: preferred school districts, commute, whether you want new construction or resale, and how HOA fees or tax rates will affect your budget.

In Texas, property taxes vary significantly from one neighborhood to another, and that difference can add hundreds of dollars to your monthly payment.

For example:

-

-

A $400,000 home in with a 1.8% tax rate costs around $600 per month in taxes

-

A $400,000 home in with a 3.3% tax-rate can exceed $1,100 per month in taxes

-

Many buyers compare different areas like Waller ISD, Magnolia ISD, and Cy-Fair ISD to find the right balance of affordability, amenities, and lifestyle.

Step 2: Find Your Texas Realtor (This Part Truly Matters)

Texas real estate moves fast and our contracts, timelines, and laws differ from many other states.

Working with a Houston-area agent includes:

-

Community expertise (flood zones, MUDs, HOAs, schools)

-

Negotiation during bidding wars

-

Guidance through inspections, repairs, and appraisal rules

-

Builder relationships for new construction

At Newcomb Realty Group, we represent buyers all across Texas, including Houston, Cypress, Katy, Spring, Tomball, Waller, and Magnolia, helping you compare neighborhoods, builders, tax rates, and resale value.

For insight on communities in the surrounding greater Houston area, see our other posts on Magnolia, Hockley, Waller and Cypress.

Step 3: Get Pre-Approved

A pre-approval gives you a clear picture of your home-buying power, including your maximum purchase price, estimated monthly payment, required down payment, interest rate options, and the loan programs you qualify for.

Working with a local Texas lender is especially valuable because they understand the nuances of Texas taxes, Houston area MUD/HOAs, and insurance; plus they can move quickly in competitive markets. Local lenders also offer Texas-specific programs, faster closing timelines, and often strengthen your negotiating position.

Newcomb Realty Group partners with trusted lenders across Houston, Cypress, Magnolia, and Katy to ensure our buyers receive accurate numbers and competitive rates from the very beginning.

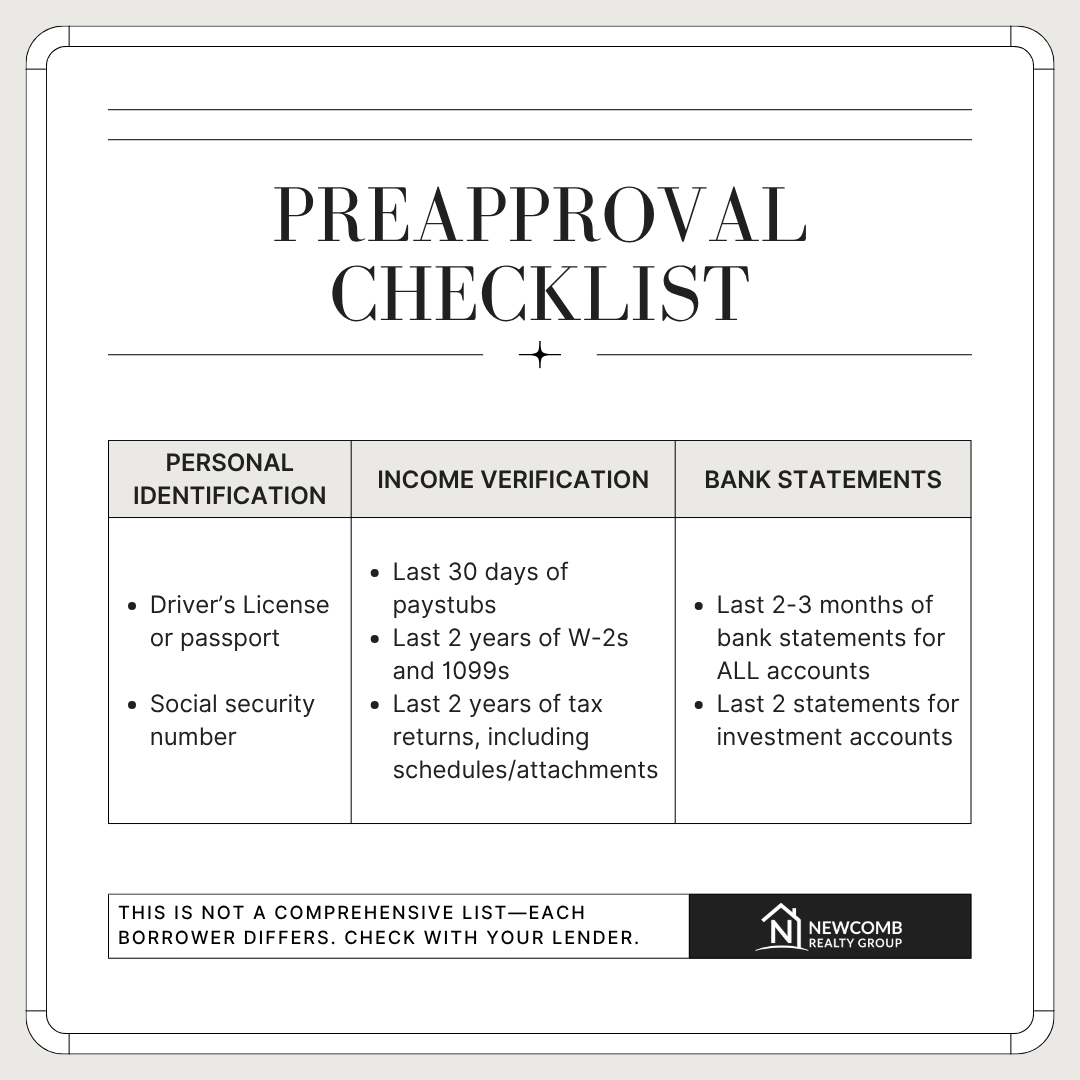

A checklist of required documents for your home loan pre-approval

A checklist of required documents for your home loan pre-approval

Step 4: Start the Home Search (Resale + New Construction)

Now the fun part begins!

For resale homes, the agent will schedule private showings, analyze comparable sales, estimate potential repairs or updates, check flood zones, and review HOA or MUD fees so you understand the full picture.

For new construction, you will be guided through comparing builders, reviewing contracts, negotiating incentives, evaluating upgrade options, monitoring the build process, and ensuring your interests are protected every step of the way.

And remember: never walk into a model home without your agent! The onsite sales representative works for the builder, not the buyer.

Step 5: Submit a Strong Offer

When you’re ready to make an offer in Texas, it typically includes your price, earnest money (about 1%), the option fee, closing date, contingencies, and financing terms. To make sure your offer is competitive, your agent will review comparable sales, local demand, days on market, the home’s condition, any repair needs, and the seller’s motivation.

With all of that in mind, we create a strong offer that protects you and gives you the best chance of getting the home.

Step 6: The Option Period (Inspections + Negotiations)

Texas buyers get an option period which is a negotiated timeframe where you can inspect the home, negotiate repairs, or back out of the contract for any reason.

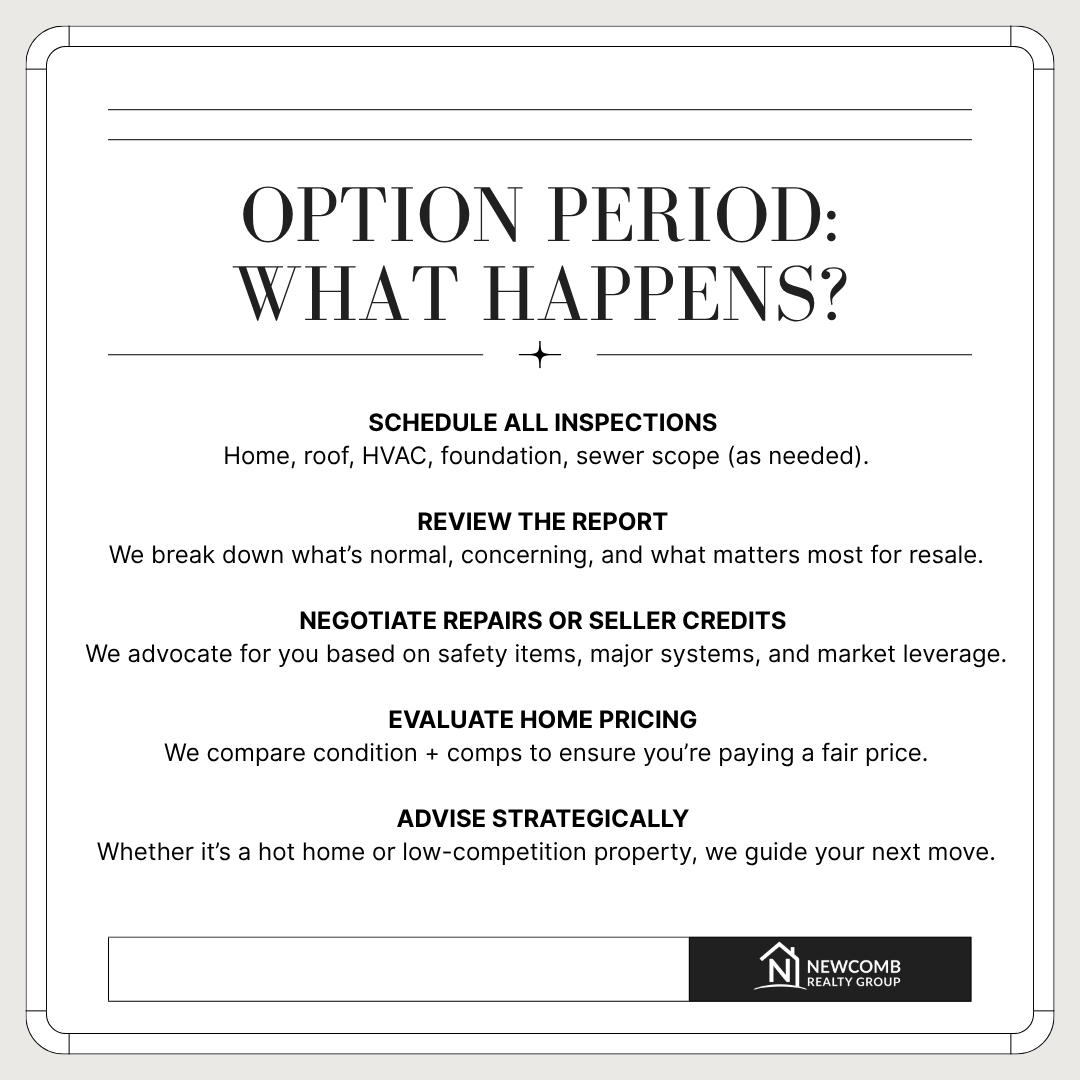

During this period we:

-

Schedule your inspections

-

Review the full inspection report with you

-

Negotiate repairs or credits

-

Assess whether the home is priced fairly

-

Advise you strategically depending on demand

During your option period if the home is not the right fit for you, your only cost is the negoitated option fee and inspection cost. This option period is designed to protect you and allows you to walk away with minimal financial loss if the home isn’t the right fit.

Step 7: Appraisal & Final Loan Approval

Your lender will order an appraisal to confirm the home’s value. If it comes in lower than the purchase price, you will have to negotiate with the seller to reduce the price, split the difference, or adjust the terms.

Once the appraisal and underwriting are complete, your loan is cleared to close.

Step 8: Final Walkthrough

During the final walkthrough, we verify that all agreed repairs are complete, the home is in the same or better condition, and all major systems and appliances are working properly.

For new builds, we also confirm that any remaining punch-list items are finished. This step ensures you receive the home exactly as promised in the contract.

Step 9: Closing Day (Welcome to Texas Homeownership!)

Closing is the final step!

This is when you sign all documents and officially become a Texas homeowner. Typical buyer closing costs include your down payment, loan origination fees, appraisal fee, survey (if needed), title fees, prepaid taxes and insurance, and any HOA transfer fees.

Once everything is signed and the loan funds, you get your keys!

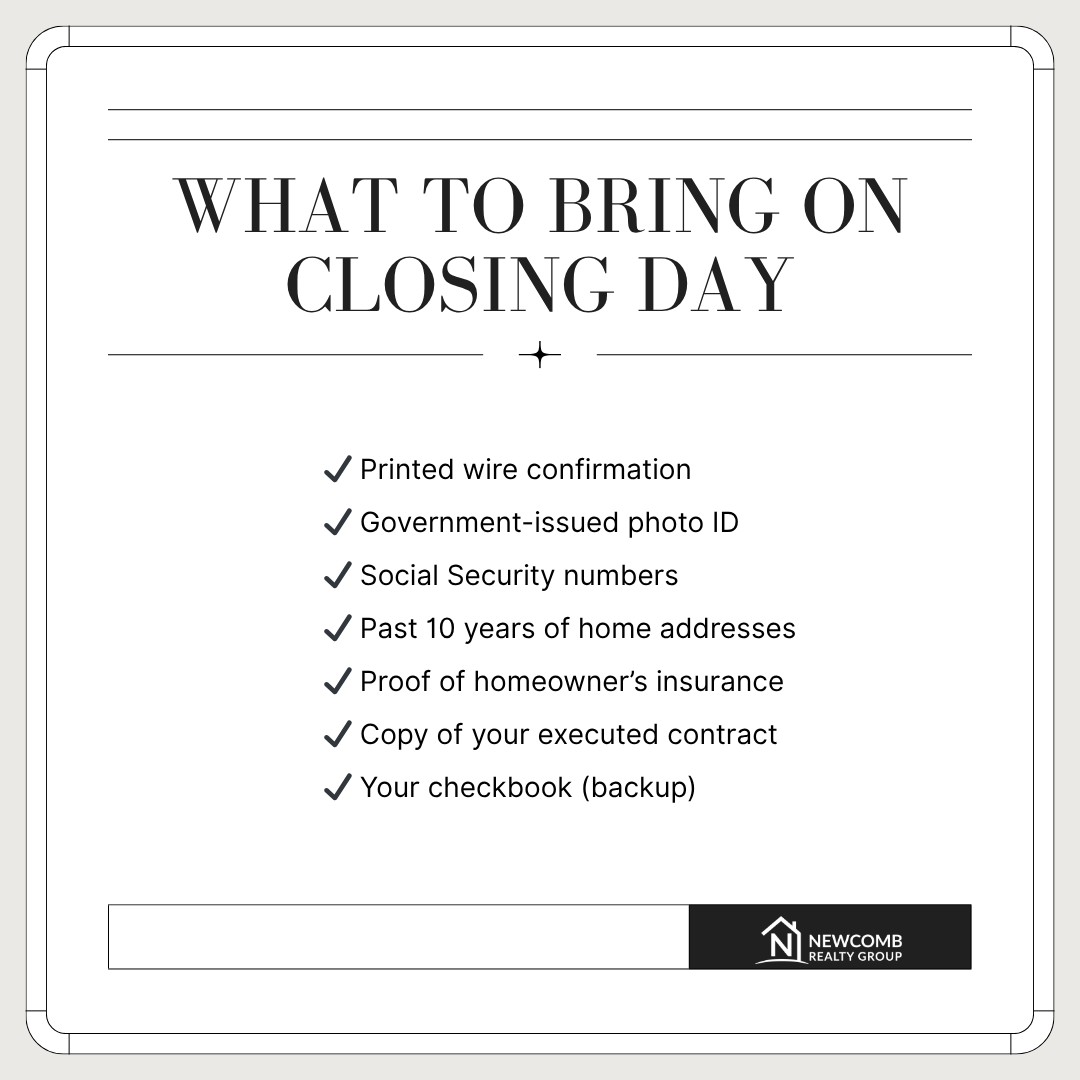

Tip: To help closing go smoothly, bring a printed confirmation of your wire transfer, a government-issued photo ID, Social Security numbers, your home addresses from the past 10 years, proof of homeowner’s insurance, a copy of your contract, and your checkbook.

Step 10: After Closing (Important Texas Must-Dos)

Once you move in, you’ll want to file your Texas Homestead Exemption, register for community amenities, and review any builder warranties if you purchased a new construction home.

And remember:

Newcomb Realty Group stays with you long-term as your market advisor, neighborhood expert, and resource for future buying, selling, and investing.

For Out-of-State Buyers: What’s Different in Texas?

Texas real estate operates differently than many states. Here’s what you need to know:

1. No state income tax: This alone attracts thousands of relocations yearly.

2. Higher property taxes than many states: These fund local schools and infrastructure. Always calculate taxes before choosing your neighborhood.

3. MUD Taxes (unique to Texas suburbs): A Municipal Utility District adds ~1–1.3% to your tax rate. We’ll review these for every property you consider.

4. Flood zones matter: Houston’s floodplain varies by street. We verify elevation, drainage, and FEMA data for every home.

5. New construction is huge here: Texas offers more new-build inventory than any other state, often with incentives unavailable elsewhere.

6. Remote buying is common: Newcomb Realty Group offers: Virtual tours, video walk-throughs, remote offer writing, digital signatures, and remote closing options in many cases

If you're planning a move to the Houston area or anywhere in Texas, we’re here to guide you with clarity, confidence, and true local expertise.

Ready to Buy a Home in Texas? We’re Here to Make It Easy.

Whether you’re local or relocating, buying new construction or resale, our team guides you through every step with clarity and confidence.

📩 Reach out for your FREE Home Buying Checklist

📞 Book a consultation call: 832-779-5478

🌐 Visit our website: www.newcombrealtygroup.com

📲 Connect with us: Instagram | Facebook | TikTok | YouTube | LinkedIn

You don’t have to figure out Texas real estate alone, we’re here every step of the way.

Categories

Recent Posts

Realtor® Listing Specialist and Team Lead | License ID: 634969

+1(972) 821-1513 | kristina.newcomb@exprealty.com